Daily Juice 048 – Money Moves in your 20s

Tip 01: Create a budget

Tip #1- Live cheaply & learn to budget

Here is the best financial advice I wish I received when I was in my 20, but I didn’t. I had to learn the hard way!

Once you bring home the bacon, you’ll need to figure out how to slice it.

Leave cheaply and learn how to budget. Without some sort plan of how you will allocate your earnings and how you will keep track on your expenses, it’s gonna be impossible to succeed.

Over the years of practice as a financial planner and seeing how many people hate budgeting and I created my own system.

First, we need to understand and explore where our money is coming from. Now, let’s be clear, this is not budgeting, we’re not counting every penny, we are building an awareness of the ebb and flow of your money.

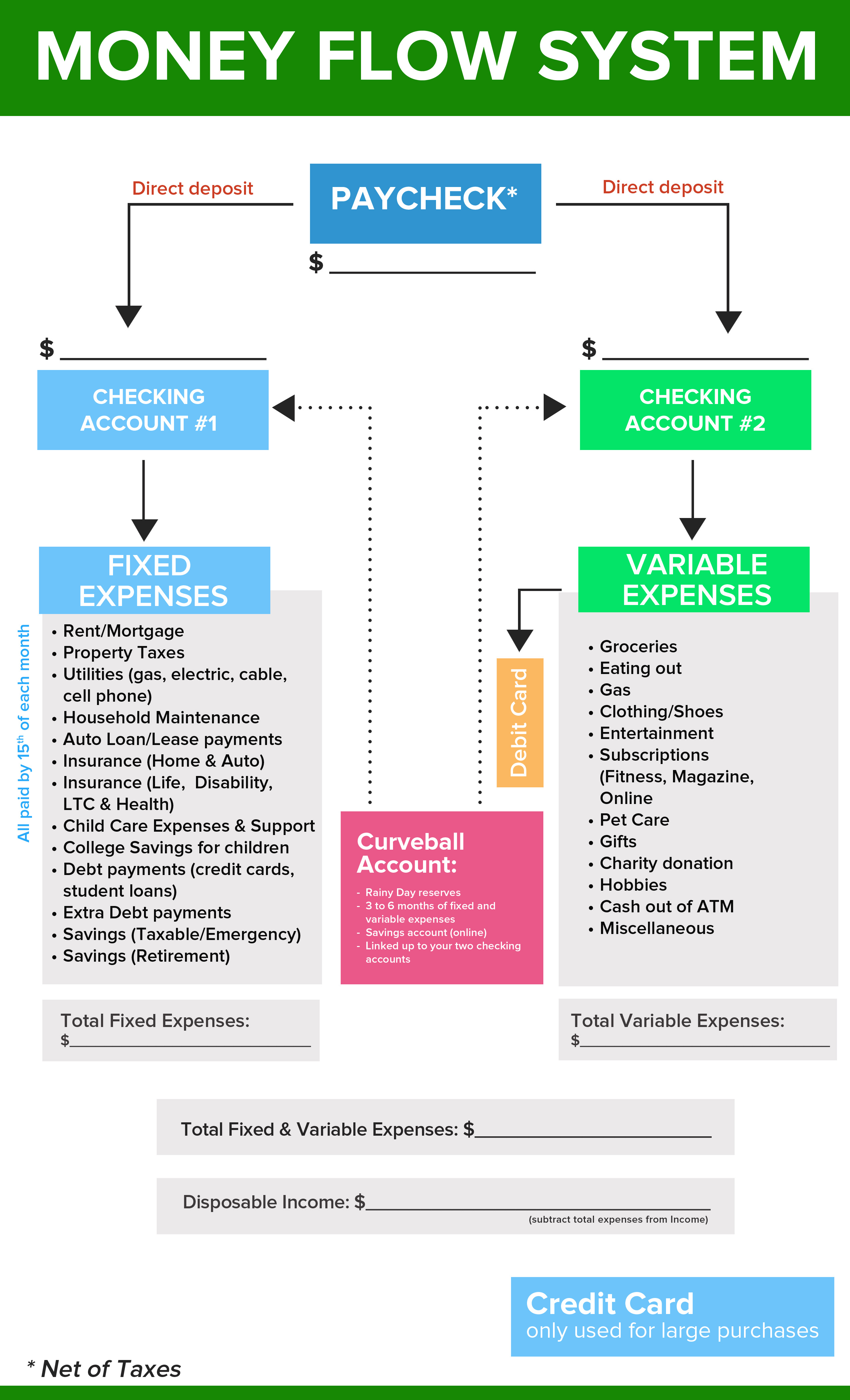

Let’s start with this Exercise (refer to Money Flow Worksheet)

Step #1

-Identify Income Sources: How much you make per month (weekly/bi-weekly)? Add up all your income

Step #2

-Look at your expenses. (Track your expenses for a few months. 2-3 months. I like using mint.com. It does the job for me. It aggregates all transactions from credit card and checking account and calculates a real picture.) To make the process easier use the Money Flow Worksheet, to list out your fixed expenses (monthly/quarterly), such mortgage or rent payment, utilities, car payments, child care expenses, debt payment, etc. Total everything

-Next, look at your variable expenses. Examples of variable expenses include things like eating out, shopping, entertainment and personal care. Total everything.

–Step #3 Add up fixed and variable expenses together.

o How much do you need to live on each month? Is it $3K, $5K or $10K? You need to know this number because it is very important for you to understand the kind of lifestyle you have, versus what kind of income that you generate. Are there adjustments needed or are you right on target?

Step #4: What is your bottom line? Subtract total fixed and variable expenses from your income. Do you have money left over? Evaluate where you stand. Knowing where you stand is a first BIG step in making budgeting to be your friend. Do you spend more then you make? Or are you living beneath your means?

These are very simple steps, but you know, it actually works! The goals here is teaching you to be aware. It’s like anything else in life if you don’t measure the results, who can you know what to improve?